The business model of online learning apps is a very simple one. Online learning keeps growing because people want skills that pay. Employers want teams who can reskill fast. Universities want reach. Platforms step in and connect all three. Coursera sits in the center of this triangle with 183 million registered learners as of June 30, 2025.

At EnactOn, we build software for founders in this EdTech space. We see the same pattern repeat across markets. Learners show up to move ahead at work. Companies pay to upskill. Universities monetize digital programs without adding buildings. The Coursera business model matches this behavior well. This article explains how Coursera makes money, why the engine scales, and what product teams can learn from it. These are the questions any founder looking to build an online learning app will ask.

Before we get into the details, a quick reality check of just how big an opportunity there is, with real numbers. Coursera’s 2024 revenue was $694.7 million across three segments: Consumer, Enterprise, and Degrees. In Q2 2025, revenue reached $187.1 million with a small GAAP net loss and positive non-GAAP profitability. Scale is real, and demand continues to rise. Now let’s start from the beginning.

What is Coursera and how does it work?

Coursera is a marketplace and a learning platform in one. Universities and industry brands publish courses, Specializations, Professional Certificates, MasterTrack modules, and full degrees. Learners enroll individually or through their employers or campuses. The platform handles discovery, delivery, assessment, certificates, and support at scale. The fact that Coursera reported 183 million registered learners by mid-2025 and hundreds of partners goes to show how Coursera works at scale.

From a product view, how does Coursera work looks like this:

● Supply side: universities and companies provide content and credentials.

● Demand side: individuals and organizations enroll and pay.

● Platform layer: catalog, search, streaming, assignments, proctoring, certificates, billing, and support.

Why this market exists in the first place

The need to reskill sits behind most decisions here. A large share of workers need new skills by 2030. That keeps the funnel full for career-focused courses and certificates. The global e-learning market will cross the $320 billion mark in 2025, which tells founders that the pie is large and still expanding.

AI adds even more urgency. Coursera alone has logged more than 10 million enrollments in generative AI courses, which shows why career programs with clear outcomes pull learners in.

This is why the Coursera business model finds traction. It organizes all that demand into clear offers and pricing.

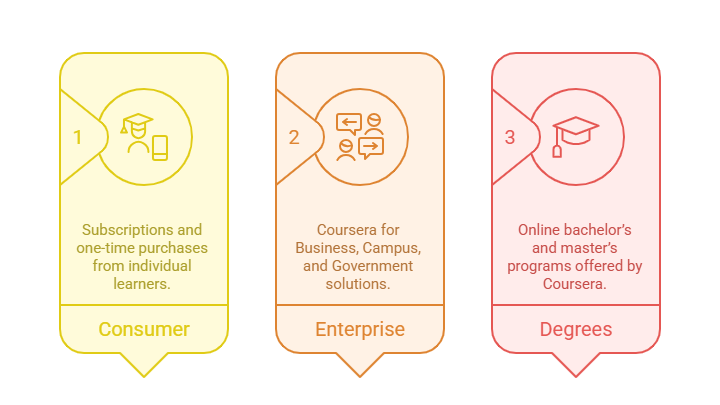

Coursera business model

The Coursera model has three revenue lines that reinforce one another. Consumer focuses on individuals. Enterprise serves companies, campuses, and governments. Degrees connects universities to online degree seekers. Together, these lines explain how Coursera makes money in practice. In 2024, Consumer brought in about $398.1 million, Enterprise $238.9 million, and Degrees $57.7 million.

Value proposition

● For learners: job-ready skills, visible certificates, and flexible pacing.

● For employers and campuses: seat-based access, analytics, and paths tied to roles.

● For universities and brands: distribution, revenue share, and data on learner demand.

Key partners

Universities, industry credential owners, and content studios.

Core activities

Content acquisition, platform development, assessment integrity, distribution, and support.

Cost structure

Content partner fees, hosting and engineering, sales and marketing, support, plus investments in assessment and academic integrity. Coursera’s gross margin in 2024 was 53 percent, which reflects partner share and platform costs.

This is the business model of Coursera in simple terms. It matches the way learners and institutions buy, which is why it scales.

How does Coursera make money?

Now on to the most important part of it all: How Coursera makes money across its main lines.

1) Consumer: Subscriptions and one-time purchases

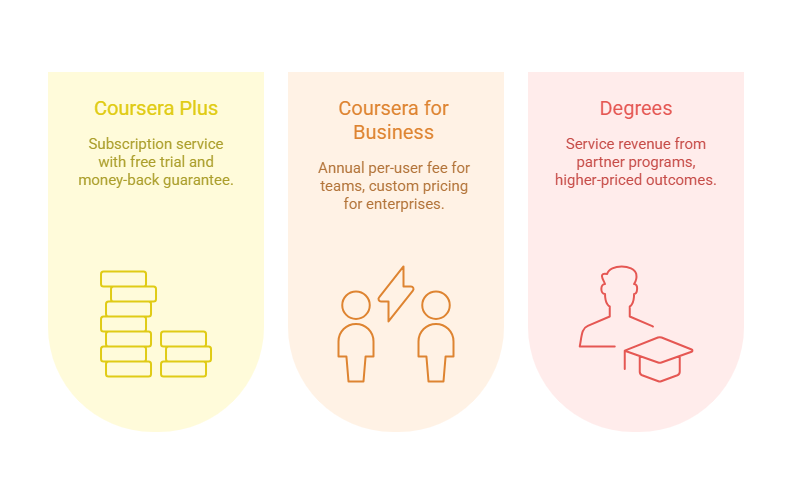

● Coursera Plus is the flagship subscription for individuals. Monthly plans start with a 7-day free trial in most regions. Annual plans come with a refund window. Subscriptions convert discovery into recurring revenue.

● One-time purchases still exist for many courses and Specializations.

● In Q2 2025, Consumer revenue was $122.8 million, helped by Coursera Plus. That shows how Coursera makes money when subscribers stay engaged.

2) Enterprise: Coursera for Business, Campus, and Government

● Teams plans price at $399 per user per year for 5 to 125 users. Enterprise contracts for larger orgs are custom. Seat licenses and learning paths drive predictable revenue, and this is a major piece of the Coursera revenue model.

● Enterprise revenue was $238.9 million in 2024 and grew again in 2025, which further explains how Coursera makes money with B2B training.

3) Degrees: Online bachelor’s and master’s programs

● Universities run degree programs on the platform. Coursera recognizes revenue for the services it provides to partners. Degrees added $57.7 million in 2024, which rounds out the Coursera revenue model.

Stack these lines together and you get a platform that grows with both individual and institutional demand. That is the essence of the Coursera business model, and it is also the clear answer to “How does Coursera make money?”.

What makes money for Coursera and why others imitate it

In our experience, founders often ask why the Coursera business model shows up in pitch decks and product roadmaps. The reasons are simple.

● High perceived value for price. A single subscription unlocks a large catalog and job-aligned certificates.

● Credibility through partners. University and industry brands make the credential signal strong.

● Multi-segment reach. Individuals, companies, campuses, and governments buy in different ways, yet share the same platform.

● Strong data flywheel. Large enrollments surface what skills are hot. New courses then target those needs.

As the market expands, many platforms follow a similar path. Udemy focuses on a creator marketplace. edX extends university reach and runs MicroMasters. FutureLearn and Udacity target career outcomes with focused paths. The business model of Coursera stands out because of the breadth of partners, the scale of learners, and the mix of Consumer and Enterprise lines that explain how Coursera makes money at scale. The global MOOC market is also projected to grow fast, which keeps the copycats coming.

Psychology behind Coursera’s popularity

Learners pick platforms that reduce friction and raise confidence. Coursera leans into three ideas.

● Clarity of outcome. Professional Certificates from brands like Google or IBM map to entry-level roles. Clear goals reduce anxiety and keep people enrolled.

● Proof that travels. Shareable certificates and LinkedIn badges act as signals. People like visible progress.

● Low commitment to start. Trials and monthly options lower the barrier. When the first week feels useful, conversion follows. Coursera reported millions of AI enrollments, which shows how fast people will try something with obvious career value.

Employers share the same psychology. Teams buy when content maps to roles and when dashboards show progress. That is why Enterprise seat licenses keep growing. So in our opinion, how does Coursera make money aligns with how buyers think.

Coursera revenue model: pricing snapshots

● Coursera Plus: 7-day free trial on monthly plans in many markets. Annual plans include a money-back window. These mechanics reduce purchase risk and power how Coursera makes money with subscriptions.

● Coursera for Business: $399 per user per year for Teams. Enterprise is custom with integrations and success support. This is a stable leg of the Coursera revenue model.

● Degrees: Service revenue tied to partner programs. This adds credibility and higher-ticket outcomes to the Coursera revenue model.

How does Coursera detect cheating?

Academic integrity matters when credentials carry weight. Coursera has rolled out features for identity checks and secure assessments. The platform supports proctoring with a lockdown browser, time and attempt limits, graded item locking, plagiarism detection, and AI-based viva exams to verify real understanding. These features help institutions maintain standards and keep certificates valuable.

Industry practices that shape revenue

A few practices show up across successful platforms and sit at the core of the Coursera revenue model and how Coursera makes money.

● Content partnerships with clear revenue share and brand lift for both sides.

● Subscriptions that convert discovery into recurring revenue.

● Seat-based licensing for Enterprise and Campus with role-based paths.

● Assessment integrity that keeps credentials credible at scale.

● Localized catalogs to reach large markets. Coursera highlights strong growth in India and other regions, which lines up with the next wave of users.

Costs and unit economics that matter

The 2024 filing shows content costs, platform spend, and sales and marketing as the largest buckets. Gross margin reached 53 percent in 2024, up from 52 percent the prior year. Gains came from a shift toward content with a lower revenue share. This matters for founders because unit economics improve when your catalog mix shifts in your favor.

Is the model profitable?

Here is the plain view. In 2024, the company posted a GAAP net loss of about 11 percent of revenue. In Q2 2025, Coursera reported a GAAP net loss of $7.8 million with positive non-GAAP net income and a double-digit adjusted EBITDA margin. This tells us the engine is getting more efficient at scale.

This is useful context for founders who plan to follow this model and build online learning apps. Paths to profitability often come from improving content cost rates, tighter go-to-market, and deeper enterprise penetration.

Product lessons for builders

If you want to build a similar product, focus on decisions that explain how Coursera makes money.

● Start with a narrow job outcome and the shortest path to a proof of skill.

● Add trials or a clear refund window to reduce risk.

● Build enterprise features early. Dashboards, SSO, integrations, and admin controls help you sell seats.

● Invest in academic integrity. Proctoring, plagiarism checks, and item locking protect certificate value.

At EnactOn, we have shipped platforms with these patterns before. If you want a faster start, explore our Coursera clone approach that gives you a foundation you can brand and extend. You can also see how we handle integrations and role-based paths in our edtech software development overview.

FAQs

Is Coursera a profitable company?

On a GAAP basis, the company reported a net loss in 2024. In Q2 2025, the company showed a GAAP net loss alongside positive non-GAAP net income and strong free cash flow for the quarter. Profitability depends on the measure you track, and the trend is improving.

How does Coursera’s free trial work?

Learners can start a 7-day free trial on Coursera Plus in most regions. Discounted promotions may not include the trial, and terms vary by offer. Annual plans include a refund window.

How does Coursera make money?

Through a mix of subscriptions and course purchases on the Consumer side, seat-based licensing for organizations, and services revenue from degree partnerships. Consumer, Enterprise, and Degrees together form the Coursera revenue model that powers growth.

What is Coursera and how does it work?

Coursera is an online learning platform where universities and companies publish courses and credentials. Individuals and organizations enroll through subscriptions, purchases, or seat licenses. The platform delivers content, assessments, certificates, and support.

What is special about the Coursera revenue model?

Three lines drive revenue: Consumer, Enterprise, and Degrees. This structure explains how Coursera makes money while balancing individuals and institutions.

How does Coursera detect cheating?

Identity checks, proctoring with a lockdown browser, time and attempt limits, graded item locking, plagiarism detection, and AI-based viva exams help keep assessments credible.

Why this topic matters for EnactOn clients

When a founder asks, “How does Coursera make money?”, we translate the answer into product and pricing decisions. The Coursera business model shows that you can serve learners and enterprises on the same platform. It also shows that academic integrity and partner economics shape long-term margins. If you plan to build in this space, we can help you design pricing, set up role-based paths, and ship faster with a similar foundation that fits your niche.

The market tailwinds are strong. The e-learning market sits above $320 billion in 2025, and millions of learners enroll every month. How does Coursera make money is not a mystery when you look at the structure. It is a system that aligns incentives across learners, employers, and universities. That is why the Coursera revenue model keeps getting imitated, and why platforms built with care continue to grow.

Quick references and stats about Coursera at a glance:

● 183 million registered learners as of June 30, 2025.

● 2024 revenue of $694.7 million across Consumer, Enterprise, and Degrees.

● Coursera Plus includes a 7-day free trial for monthly plans in many regions.

● Teams plan priced at $399 per user per year.

● Academic integrity features include proctoring, lockdown browser, and plagiarism detection.

● The e-learning market projection for 2025 is about $321 billion.

If you are exploring a product inspired by Coursera, or you want help mapping how Coursera makes money to your own market, talk to us. We can start with discovery, shape the catalog and pricing, and ship a first version that you can grow. Talk to someone on our team now.